Medicare Supplement Plans Comparison Chart 2024

Medicare supplement plans, also known as “Medigap,” come in ten options, A, B, C, D, F, G, K, L, M & N.

Each plan has a different level of coverage for the out-of-pocket costs, not covered by Original Medicare Parts A & B.

Some plans offer fully comprehensive coverage, others pay a percentage of expenses.

Medigap plans are available from private healthcare insurers across the United States.

You’ll find options on Medigap policies in every state, but not all insurers coverall states.

Providers may also offer different coverage in states like Wisconsin, Minnesota, and Massachusetts, where there are different rules around Medigap policies and the coverage they offer.

However, in most other states, the Federal government standardizes the coverage in all Medigap policies.

That means you’ll get the same coverage and benefits from any insurer in all states.

Finding the right plan to suit your needs can be a daunting task. Evaluating the coverage offered by each plan can take hours of due diligence.

We put together this post giving you a Medicare supplement plans comparison chart for 2024.

Get a Free Consultations for Medicare Supplement Plans

Reach out to our team at 1-888-891-0229 for a free consultation and quote on any Medigap plan.

Our knowledgeable and experienced agents work with all insurers, and we’ll get you the best rate on any plan in your state.

You can use the free tool on our site for an automated quote or leave your details on the contact form, and we’ll get one of our Medigap experts to call you back to discuss your healthcare needs.

Compare Plans & Rates

Enter Zip Code

What Are the Different Medicare Supplement Plans?

There are ten Medigap plans in 2024, each offering a different level of coverage.

The Federal government regulates the benefits provided by Medigap policies.

However, some policies have better coverage than others. Here’s a basic breakdown of what you can expect from each plan.

- Medigap Plan A — Offering basic benefits. It’s an affordable plan for low-income seniors, covering most out-of-pocket expenses involved with Medicare Part A.

- Medigap Plan B — Offers similar benefits to Plan A but covers the Part A deductible.

- Medigap Plan D — A mid-priced plan covering most Medicare Part A & B expenses.

- Medigap Plan G — Available in standard and high-deductible versions from select insurers and some states. It offers the most comprehensive coverage level for people who don’t qualify for Plan F.

- Medigap Plan F — The most comprehensive Medigap policy, including coverage for the Part B deductible ($226 for 2023).

- *Plans F & C are only available to people qualifying for Medicare before January 1, 2020.

- Medigap Plan K — A low-cost plan offering 50% coverage for most Part A & B benefits.

- Medigap Plan L — A low-cost plan offering 75% coverage for most Part A & B benefits.

- Medigap Plan M — Coverage for most Medicare Part A & B benefits, but pays half the Part A deductible.

- Medigap Plan N — Low premiums but requires paying Part B excess charges and copayments at the doctor and emergency room.

What do Medigap Plans Cover?

Medigap policies offer significant coverage to account for the remaining costs that Medicare Parts A & B leave unpaid.

All Plans offer the following benefits.

- Part A coinsurance and hospital costs for up to 365 days after using up Medicare benefits.

- Part A hospice care coinsurance or copayment.

- Part B coinsurance or copayment.

- Blood transfusion costs for the first three pints of blood.

Plan F, G, and N Offer the following additional benefits for Medicare Parts A & B

- Part A deductible.

- Part B excess charges (Plan N doesn’t cover these charges).

- Skilled nursing facility care coinsurance.

- 80% of emergency healthcare costs when traveling outside the US for 60 days. ($250 deductible and $50,000 maximum apply).

- Unlimited coverage for all out-of-pocket costs.

What Do Medicare Supplement Plans Not Cover?

Medigap plans cover the remaining 20% of out-of-pocket costs not covered by Original Medicare Parts A & B.

Medigap policies don’t cover the cost of prescription drugs, long-term care at nursing homes, private nursing care, and vision, dental, and hearing services.

Where Can You Buy a Medicare Supplement Plan?

We’re an independent agency that shops all the best rates from top companies to help make sure you pay the least amount possible for the best coverage with your Medigap plan.

And our service is entirely FREE.

We represent leading insurers like Blue Cross Blue Shield, Humana, Aetna, Mutual of Omaha, and many more.

Some companies have niche offerings that only focus on a few plans, while others provide a comprehensive selection of plans.

Some insurers only service some states.

So, the best thing to do is to reach out to us for information on the best provider in your state, offering the lowest premiums and plenty of additional perks and benefits.

What Are the Premiums for Medicare Supplement Plans?

Premiums for Medigap policies vary between providers and states.

For instance, one provider might be cheaper for Plan G in your state than other insurers. However, they might be the more expensive option in another.

Insurers also set your premiums based on age, gender, and smoking status.

Typically, men and smokers will pay higher premiums than nonsmokers and women because they present a higher insurance risk to the provider.

Plan F & G are the most expensive plans because they offer the best coverage.

However, you can get high-deductible versions of Plans F & G that reduce the premiums but increase the Part A deductible from $1,600 to $2,700.

Plan N is another good option for healthy seniors that want good coverage for medical emergencies but lower monthly premiums.

Plan N requires you to make a $20 copayment at the doctor’s and a $50 copayment when visiting the emergency room, waived if you’re admitted to the hospital.

Plan N also doesn’t cover Part B excess charges.

Excess charges are the additional fees charged on top of the Medicare-approved rate.

For instance, the government allows Medicare practitioners to charge up to 15% more for their services than the “Medicare assignment” rate.

You’re liable to pay these charges if you have Plan N, but Plans G & F cover these additional charges.

You’re liable to pay these charges if you have Plan N, but Plans G & F cover these additional charges.

Or you can mitigate these costs by seeing medical practitioners charging the Medicare assignment rate.

There’s a Medigap plan to suit any budget and any healthcare requirement.

Speak to our team for a free consultation on the right plan to suit your unique situation.

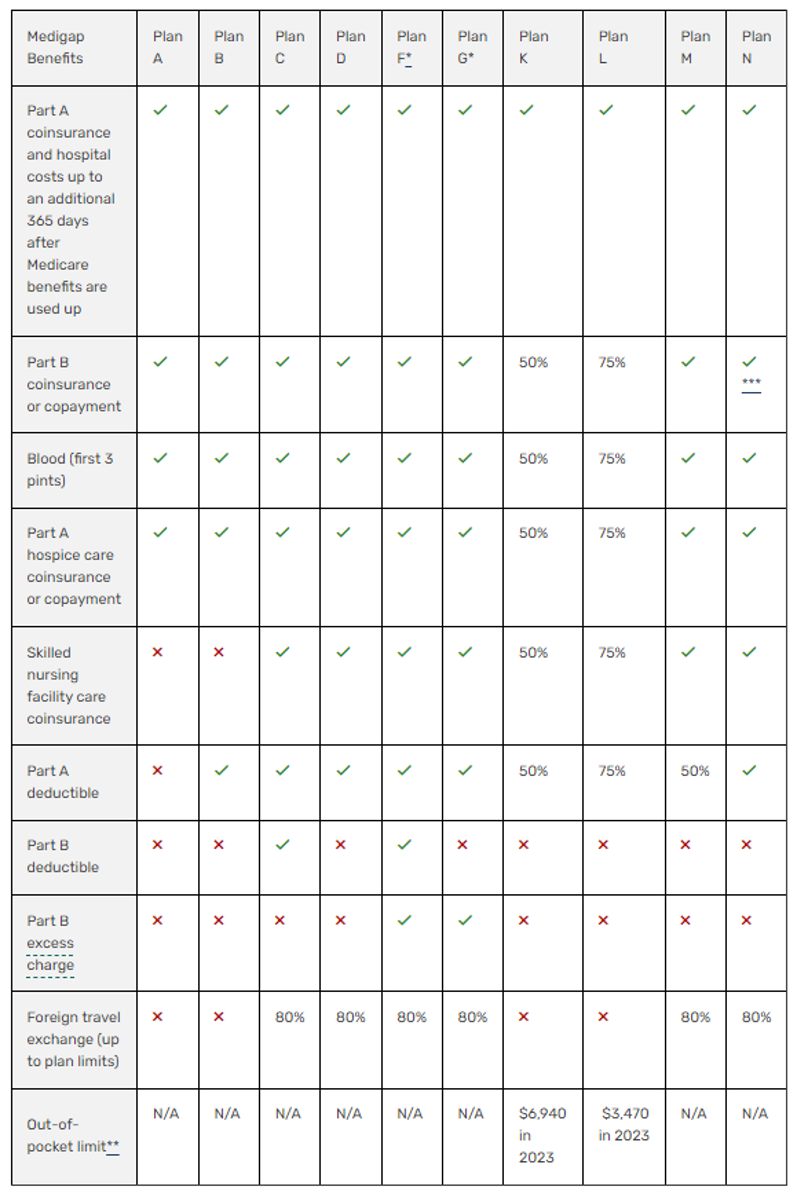

Medicare Supplement Plans Comparison Chart 2024

Here’s a chart to give you an idea of the differences in coverage between Medigap plans.

Insurers increase prices on premiums each year, and the Part A & B deductibles may change depending on Federal guidelines.

The Best Medicare Supplement Plans for 2024

Medicare Plan G

Medicare Plan G stands as a robust and popular choice among Medicare Supplement Plans. Known for its extensive coverage, Plan G offers a safety net for beneficiaries, handling many out-of-pocket costs associated with healthcare.

Plan G covers most Medicare Part A and Part B costs, including hospital stays, nursing care, and outpatient services.

Notably, it offers protection against Part B excess charges, helping beneficiaries avoid unexpected expenses. While Plan G covers the majority of healthcare costs, beneficiaries are responsible for the annual Part B deductible, a minor out-of-pocket expense compared to the coverage provided.

Importantly, Plan G includes coverage for emergencies during foreign travels, an essential benefit for those with a penchant for exploration.

Like all Medicare Supplement plans, it provides nationwide coverage, allowing beneficiaries to choose any healthcare provider in the U.S. who accepts Medicare. Beneficiaries seeking a balance between comprehensive coverage and affordability often find Plan G to be an optimal choice.

Medicare Plan N

For those seeking a balance between coverage and cost, Medicare Plan N emerges as a viable option. Known for its lower premiums, Medicare Supplement Plan N offers beneficiaries substantial coverage without the hefty price tag often associated with more comprehensive plans.

Plan N covers many costs associated with Medicare Part A and Part B, including hospital stays, nursing care, and outpatient services.

However, it does not cover Part B excess charges, which means beneficiaries may face some out-of-pocket costs if a healthcare provider charges above Medicare’s standard rates.

Also, Plan N involves a small copayment for office visits and emergency room trips.

Like its counterparts, Plan N provides foreign travel emergency coverage and allows beneficiaries to choose any healthcare provider in the U.S. who accepts Medicare.

Medigap Plan N proves an appealing choice for those who are budget-conscious but still desire robust coverage. As with any health plan, potential Plan N beneficiaries should evaluate their specific healthcare needs and budget before choosing their plan.

Medicare Plan F

Medicare Plan F, often referred to as the “Cadillac of Medicare Supplement Plans,” provides beneficiaries with the most comprehensive coverage available.

As one of the broadest plans in the Medicare landscape, it pays for all costs not covered by Original Medicare, making it a favorite among those seeking worry-free healthcare in their golden years.

Plan F covers hospital bills, doctor visits, and other healthcare services approved by Medicare. It eliminates out-of-pocket costs by covering deductibles, coinsurance, and copayments, providing real peace of mind for beneficiaries.

Unique to Plan F is the coverage of Part B excess charges, costs that healthcare providers may charge over and above Medicare’s standard fees.

Moreover, Plan F includes foreign travel emergency coverage, a valuable feature for avid globetrotters.

With nationwide coverage, beneficiaries can choose any provider in the U.S. who accepts Medicare, providing freedom of choice. Although Plan F offers extensive coverage, it often comes with higher premiums. Potential Plan F beneficiaries should evaluate their healthcare needs and budget before making their decision.

Frequently Asked Questions

What is a Medicare Supplement Plans comparison chart for 2024?

A Medicare Supplement Plans comparison chart for 2024 displays the different plans, their benefits, costs, and coverage. It helps compare and choose the best plan.

How can I access a Medicare Supplement Plans comparison chart for 2024?

Reach out to our team at 1-888-891-0229 for up-to-date charts on available plans.

What information does a Medicare Supplement Plans comparison chart for 2024 provide?

The chart includes plan names, coverage details, deductibles, limits, copayments, and additional benefits.

Can I find a state-specific Medicare Supplement Plans comparison chart for 2024?

Yes, comparison charts can be specific to your state, allowing you to see available plans in your area.

What factors should I consider when using a Medicare Supplement Plans comparison chart for 2024?

Consider coverage needs, budget, company reputation, and specific healthcare requirements.

Can I enroll directly from a comparison chart?

No, contact the insurance company or work with an agent to enroll in a plan.

Are prices included in a Medicare Supplement Plans comparison chart for 2024?

Prices may not be included, as they vary based on age, location, and insurance company.

How often should I refer to a Medicare Supplement Plans comparison chart for 2024?

Refer to the chart when enrolling or changing plans, and review annually for updates.

Can I customize a Medicare Supplement Plans comparison chart for 2024?

While you can’t customize the chart, create your own comparison by noting specific plan details.

Is a Medicare Supplement Plans comparison chart for 2024 the only resource I should use?

If you need further assistance in selecting the right Medicare Supplement Plan for your healthcare needs, contact us.

Medicare Supplement Plans - How to Apply

The easiest way to get started is to call us today at 1-888-891-0229.

We’ll answer all of your questions and help you find the right Medicare plan. Or you can use our FREE quote engine to begin shopping today!

Updated December 4th, 2022