What is Medicare Plan N?

Navigating the world of Medicare can be overwhelming, but finding the right plan for your needs is essential.

What is Medicare Plan N?

It is a popular option for those who want a balance of comprehensive coverage and affordability.

This blog post is your ultimate guide to understanding and choosing Medicare Plan N, a flexible, budget-friendly supplement plan that could be the perfect fit for your healthcare needs.

Short Summary

- Medicare Plan N is a Medicare policy providing cost-sharing benefits for coinsurance costs, copays, and emergency room visits.

- It offers lower premiums, flexibility, and nationwide coverage making it an attractive option to minimize healthcare expenses.

- Careful consideration of all associated costs including premiums, copays & out-of-pocket expenses is essential when evaluating the affordability of different Medigap plans.

Understanding Medicare Plan N

Medicare Plan. N is a standardized Medigap policy designed to help cover out-of-pocket healthcare costs such as coinsurance and copays for hospitalization, hospice care, and skilled nursing facilities.

As one of the many Medicare supplement plans available, Plan N provides considerable cost-sharing benefits to policyholders, making it an attractive choice for those looking to minimize their healthcare expenses.

Plan N is a great option for those who want to reduce their out-of-pocket costs while still having access to quality healthcare.

It offers a variety of benefits, including coverage for coinsurance and copays, as well as coverage for hospitalization, hospice care, and skilled nursing facilities.

The Basics of Medicare Plan N

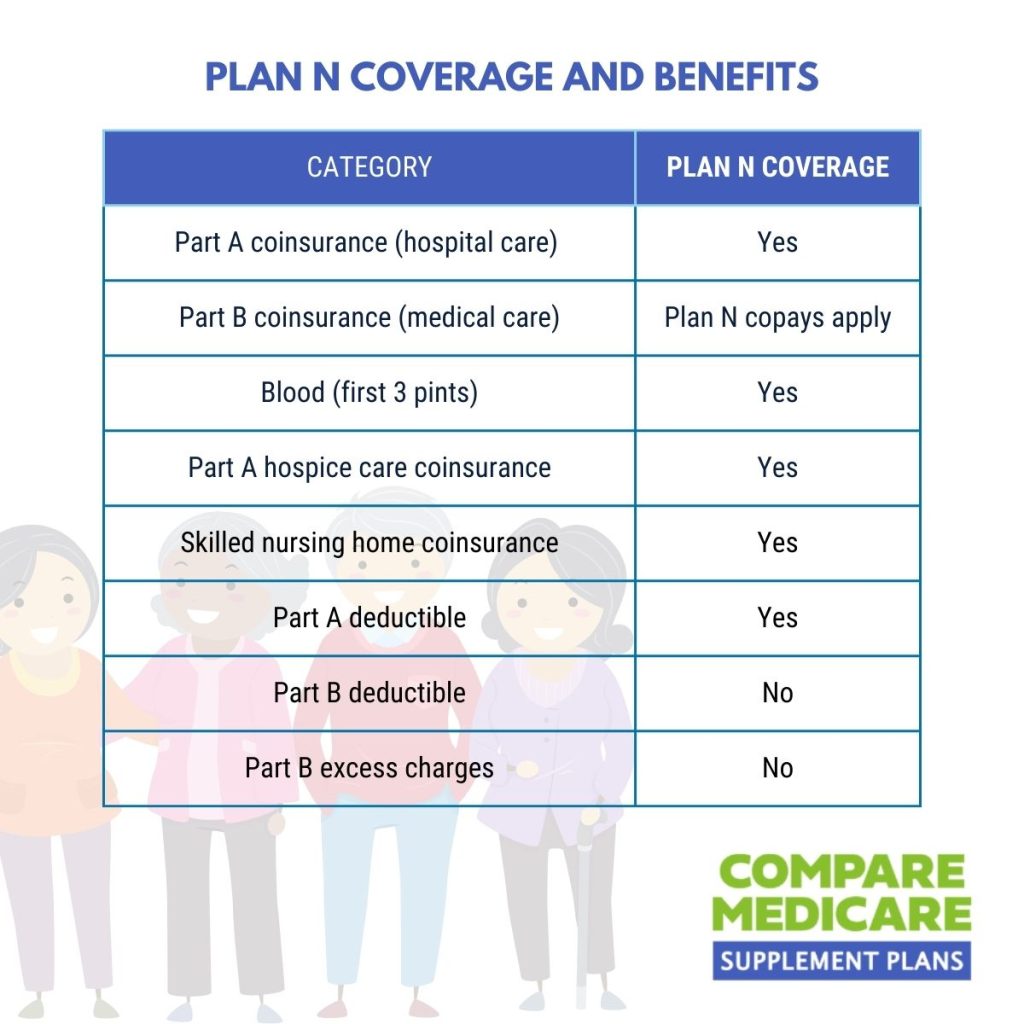

Medicare Plan. N offers coverage for a variety of medical services, filling the gaps left by Original Medicare.

It covers coinsurance costs for Medicare Part A, Medicare Part B, hospice care, and skilled nursing facilities, as well as copays for physician and emergency room visits.

However, it’s essential to understand that Plan N does not cover the Medicare Part B deductible or excess charges, and copays or coinsurance may still apply for doctor’s office and emergency room visits.

One of the most appealing aspects of Medicare Plan N is its affordability.

One of the most appealing aspects of Medicare Plan N is its affordability.

With an average monthly premium ranging from $120 to $180, Plan N is more budget-friendly than many other Medigap plans.

However, it’s important to note that a copay of $50 is required for emergency room visits that don’t result in inpatient admission, and a $20 copay is required for doctor’s appointments.

Despite these copays, many beneficiaries find that the lower monthly premiums make Medicare Plan N an attractive option.

How Medicare Plan N Complements Original Medicare

While Original Medicare (Parts A and B) provides coverage for many healthcare services, it doesn’t cover everything.

That’s where Medicare Plan N comes in, offering additional coverage to help fill in those gaps.

Plan N covers copays and coinsurance charges for Part B benefits, with some copays applicable.

For example, when seeing a physician, Medicare covers 80% of approved charges, and Plan N covers the remaining amount after a $20 copay.

In the case of an emergency room visit without hospital admission, Plan N pays 80% of approved charges, with a $50 copay required.

Plan N provides coverage for 80% of foreign travel emergency costs. This is not something that is covered by Original Medicare.

Top providers like Aetna, Cigna, and AARP/UnitedHealthcare offer Plan N as part of their Medicare supplement plans.

It’s important to remember that all providers of Plan N offer the same core benefits, ensuring consistency in coverage no matter which carrier you choose.

Compare Plans & Rates

Enter Zip Code

Benefits of Choosing Medicare Plan N

One of the main advantages of selecting Medicare Plan N is its lower monthly premiums compared to other Medigap plans.

This cost-effective option can be particularly appealing to those on a tight budget or who want to minimize their healthcare expenses.

In addition to lower premiums, Medicare Plan N offers flexibility and nationwide coverage, making it a great choice for individuals who value both affordability and comprehensive coverage.

Lower Monthly Premiums

The lower monthly premiums of Medicare Plan N are a significant selling point for many beneficiaries.

On average, Plan N premiums range between $120 and $180 per month, though they can be as low as $80 or as high as $200 depending on location.

By comparing both the coverage and costs of Plan N with other Medigap plans, potential enrollees can find an option that best suits their healthcare needs and financial situation.

Flexibility and Nationwide Coverage

Aside from its lower premiums, Medicare Plan N also offers nationwide coverage, giving beneficiaries the flexibility to receive care from any provider that accepts Medicare.

This can be especially beneficial for those who travel frequently or have multiple residences, as they can be confident in knowing their healthcare coverage will remain consistent across the United States.

With its combination of affordability, flexibility, and comprehensive coverage, Medicare Plan N is an attractive option for many Medicare beneficiaries.

Comparing Medicare Plan N to Other Medigap Plans

When comparing Medicare Plan N to other Medicare plans, it’s important to consider both the coverage provided and the associated costs.

While Plan N offers lower premiums than some other Medigap plans, it does require copays for certain medical services.

For example, Plan G, another popular Medigap plan, offers comprehensive coverage with higher monthly premiums but no copays for doctor visits or emergency room visits that do not result in hospitalization.

Coverage Differences

Specific coverage differences between Medicare Plan N and other Medigap plans can have a significant impact on your overall healthcare costs.

For example, while Plan N requires a $20 copay for doctor visits and a $50 copay for emergency room visits that don’t result in hospitalization, Plan G covers these services without the need for copays.

Understanding these coverage differences is essential when choosing the Medigap plan that best suits your needs.

Cost Considerations

When comparing the costs of Medicare Plan N to other Medigap plans, it’s important to consider not only the monthly premiums but also the copays and other out-of-pocket expenses.

For example, while Plan N may have a lower monthly premium than Plan G, the additional copays required for doctor visits and emergency room visits can add up, potentially offsetting the savings from lower premiums.

Thoroughly evaluating the costs associated with each plan can help you make an informed decision about which Medigap plan is the best fit for your healthcare needs and budget.

Eligibility and Enrollment for Medicare Plan N

Eligibility for Medicare Plan N is contingent upon enrollment in Medicare Part A and Part B, with certain limitations for those who miss the enrollment period or have a Medicare Advantage Plan.

Understanding eligibility requirements and enrollment periods for Medicare Plan N is crucial in ensuring you are able to access this valuable supplemental coverage.

Who Can Enroll in Plan N?

To be eligible for Medicare Plan N, you must be enrolled in both Medicare Part A and Part B and reside in the service area of the plan you choose.

It’s important to be aware of these eligibility requirements, as failure to meet them may result in the inability to enroll in Plan N or other Medigap plans.

When to Enroll in Plan N

The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment period, which begins on the first day of the month in which you are both 65 years old and enrolled in Medicare Part B, and lasts for six months.

The best time to enroll in Medicare Plan N is during your Medigap Open Enrollment period, which begins on the first day of the month in which you are both 65 years old and enrolled in Medicare Part B, and lasts for six months.

Enrolling during this period ensures that you won’t be subject to medical underwriting, allowing you to access the most affordable rates for your chosen plan.

Missing this enrollment period may result in higher premiums or even a denial of coverage based on your health status.

Costs Associated with Medicare Plan N

The costs associated with Medicare Plan N include premiums, copays, and excess charges, with prices varying by location, age, and pricing method.

It’s important to understand these costs when considering Plan N, as they can have a significant impact on your overall healthcare expenses.

Premiums and Copays

Medicare Plan N premiums can range from $80 to $200 per month, depending on factors such as location, age, gender, and health status.

In addition to these monthly premiums, Plan N also requires copays for certain services, such as a $20 copay for doctor visits and a $50 copay for emergency room visits that don’t result in hospitalization.

Understanding these costs can help you make an informed decision about whether Medicare Plan N is the right choice for you.

Excess Charges and Other Out-of-Pocket Costs

Medicare Plan N does not cover Medicare Part B excess charges. These are additional amounts charged by providers if their rates are not approved by Medicare.

Medicare Plan N does not cover Medicare Part B excess charges. These are additional amounts charged by providers if their rates are not approved by Medicare.

These excess charges, along with other out-of-pocket expenses such as deductibles, coinsurance, and copayments, should be taken into account when evaluating the overall costs of Medicare Plan N.

Medicare Plan N vs Plan G

When it comes to Medicare Supplement plans, two popular choices among beneficiaries are Medicare Plan N and Plan G. Both plans offer additional coverage to fill the gaps in Original Medicare, providing financial protection and peace of mind.

Understanding the differences between these plans can help you make an informed decision about which one best suits your needs.

Medicare Plan N offers comprehensive coverage for out-of-pocket costs, including hospitalization coinsurance, skilled nursing facility coinsurance, and the Part A deductible.

It also covers Part B coinsurance or copayments, except for a small copayment for certain doctor visits and emergency room visits. Additionally, Plan N provides coverage for foreign travel emergency care, making it an appealing option for those who frequently travel outside the United States.

Medicare Part B Deductible

On the other hand, Medicare Plan G offers similar benefits to Plan N but with one key difference: it covers the Part B deductible. This means that with Plan G, beneficiaries are not responsible for paying the Part B deductible out of pocket.

The coverage for other costs, such as hospitalization coinsurance, skilled nursing facility coinsurance, and Part A deductible, remains the same as in Plan N. Plan G offers a high level of coverage, making it a popular choice among Medicare beneficiaries.

The main cost-sharing difference between Plan N and Plan G lies in copayments. With Plan N, beneficiaries are responsible for a small copayment for certain doctor visits and emergency room visits.

However, these copayments are usually predictable and affordable. In contrast, Plan G does not require copayments for such visits, providing more comprehensive coverage without these additional costs.

Cost of Plan G vs Plan N

When comparing the premiums of Plan N and Plan G, it’s important to note that costs can vary depending on factors such as location, age, gender, and the insurance company offering the plans.

When comparing the premiums of Plan N and Plan G, it’s important to note that costs can vary depending on factors such as location, age, gender, and the insurance company offering the plans.

In general, Plan G tends to have higher premiums compared to Plan N due to its more extensive coverage, including the Part B deductible.

However, the difference in premiums may vary among insurance providers, so it’s essential to compare plans and prices from different companies.

Ultimately, the choice between Medicare Plan N and Plan G comes down to individual needs and preferences.

If you are comfortable with the small copayments associated with Plan N and prefer lower monthly premiums, it can be a cost-effective option.

On the other hand, if you prefer comprehensive coverage that includes the Part B deductible and are willing to pay slightly higher premiums, Plan G may be a better fit.

It’s worth noting that Medicare Supplement plans, including Plan N and Plan G, are standardized by the government, meaning that the benefits provided are the same across different insurance companies.

However, pricing, additional perks, and customer service may vary among insurers, so it’s important to research and compare plans from reputable companies.

Before making a decision, it’s advisable to review your healthcare needs, budget, and personal circumstances. Consider factors such as your anticipated medical expenses, preferred healthcare providers, and frequency of travel to determine which plan aligns best with your requirements.

In conclusion, both Medicare Plan N and Plan G offer valuable coverage options for Medicare beneficiaries. By comparing their benefits, costs, and suitability to your individual situation, you can choose the plan that provides the necessary financial protection and peace of mind throughout your healthcare journey.

Selecting a Carrier for Medicare Plan N

Choosing the right carrier for your Medicare Plan N is an important step in ensuring you receive the best coverage and service possible.

To make an informed decision, it’s crucial to compare top-rated carriers and their rates, as well as customer service reviews.

This can help you find a carrier that not only offers competitive pricing but also provides reliable and responsive support when you need it most.

Top-Rated Carriers

Some of the top-rated carriers for Medicare Plan N include Aetna, Cigna, Allstate, Mutual of Omaha, Manhattan Life, and many more.

It’s important to note that all providers of Plan N offer the same core benefits, ensuring consistency in coverage no matter which carrier you choose.

By comparing these top-rated carriers, you can be confident in selecting a provider that offers quality coverage and service.

Tips for Comparing Rates

When comparing rates for Medicare Plan N, it’s important to consider not only the carrier’s reputation but also its rate increase history and any discounts it may offer.

When comparing rates for Medicare Plan N, it’s important to consider not only the carrier’s reputation but also its rate increase history and any discounts it may offer.

Additionally, researching carrier reviews can help you gauge the quality of their customer service and support, ensuring that you choose a carrier that will be responsive and reliable when you need assistance.

Taking the time to thoroughly compare rates and carriers can help you make the best decision for your healthcare needs.

Travel and Medicare Plan N

For those who love to travel, Medicare Plan N offers the added benefit of covering 80% of emergency medical costs outside the United States.

This coverage can provide peace of mind and financial protection should you require emergency medical care while exploring the world, making Medicare Plan N an ideal choice for travelers who want comprehensive coverage both at home and abroad.

With Medicare Plan N, you can enjoy the freedom of traveling without worrying about the cost of medical care.

You can rest assured that you will be covered in the event of an emergency, no matter where you are in the world.

Evaluating Your Medicare Supplement Needs

Before selecting a Medigap plan like Medicare Plan N, it’s important to evaluate your healthcare needs and financial situation.

This involves understanding your current health status, anticipated future healthcare needs, and budget constraints.

By researching different Medigap plans and their associated costs, you can make an informed decision about which plan is the best fit for your individual circumstances.

When considering Medicare Plan N, keep in mind the factors that influence premium costs, such as location, age, and pricing method.

Additionally, be aware of potential out-of-pocket expenses, such as copays and excess charges, that may impact your overall healthcare costs.

By carefully evaluating your Medicare supplement needs, you can ensure that you choose the plan that provides the best balance of coverage and affordability for your unique situation.

Summary

In conclusion, Medicare Plan N is a popular and flexible Medigap plan that offers a balance of comprehensive coverage and affordability.

With lower monthly premiums, nationwide coverage, and coverage for emergency medical costs outside the US, Plan N can be an attractive option for many Medicare beneficiaries.

However, it’s essential to consider not only the premiums but also the copays and other out-of-pocket expenses associated with this plan when determining if it’s the right choice for you.

Frequently Asked Questions

What is the difference between Plan N and Plan G?

The primary difference between Medicare Supplement Plan N and Plan G is that Plan N has copayments and excess charges for certain medical services, while Plan G covers 100% of these costs.

Therefore, if you are likely to need to pay the copayments or excess charges often, Plan G may be the better choice.

What are the disadvantages of Plan N?

The disadvantages of Medicare Plan N include copayments for some doctor visits and emergency room visits, as well as no coverage for Part B excess charges.

Furthermore, certain preventative care services, such as an annual physical, are not covered under this plan.

What are the benefits of Plan N?

Plan N offers a great way for seniors to save on healthcare costs while still receiving quality coverage.

It includes coverage for Part A co-insurance and hospital costs, along with coverage for certain medical expenses, such as doctor’s visit copayments.

Additionally, this plan has very low premiums, which makes it an attractive option for those looking for an affordable way to cover their medical needs. Overall, Plan N is a cost-effective option that ensures seniors are able to receive necessary healthcare.

Medicare Plan N - How to Apply

By understanding the basics of Medicare Plan N, comparing it to other Medigap plans, and evaluating your individual healthcare needs, you can make an informed decision about whether this plan is the best fit for your healthcare coverage.

With the right information and resources, you can feel confident in your choice and enjoy the peace of mind that comes with comprehensive and affordable healthcare coverage.

The easiest way to get started is to call us today at 1-888-891-0229.

Updated December 4th, 2022