Compare Medicare Supplement Plans 2024

If you are enrolled in or plan on enrolling in Medicare Part A and Part B for 2024, it’s a wise idea to plan ahead and start comparing Medicare Supplement Insurance plan now.

Medicare Supplement plans in 2024 can help to save you a lot of money on the services that Original Medicare doesn’t cover.

- Which Medicare Supplement plans are the best options for 2024?

- How do you determine which option is the right one for you?

To make the most informed decision and determine which Medicare Supplement plan is the best option for you, please continue reading.

How Medicare Supplement Insurance Plans Work

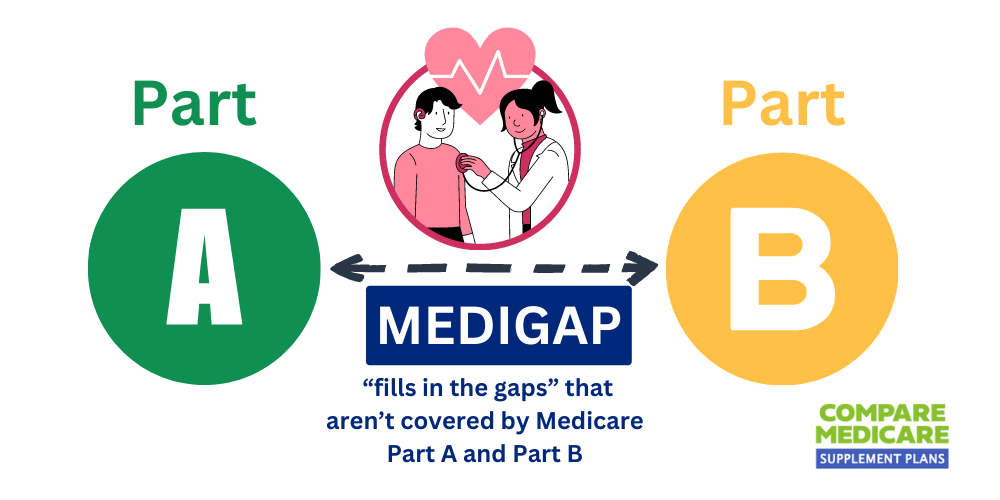

Medicare Supplement Insurance is also known as Medigap, as it covers the “gaps” in Original Medicare.

Original Medicare is comprised of two parts: Part A, which covers the costs of inpatient medical care, such as hospital stays, and Part B covers the costs that are associated with outpatient medical care, such as doctor’s appointments.

Original Medicare doesn’t cover everything, however; beneficiaries are expected to cover the cost of copays, coinsurance, and deductibles, for example, themselves. Medigap policies help to cover these out-of-pocket expenses.

There are several different Medicare Supplement Insurance plans, and they can be purchased from private insurance companies.

These policies are identified by letters and all are standardized, meaning that all lettered policies must offer the same basic benefits that have been approved by the federal government; in other words, if you purchase Medigap Plan N, your policy must offer the same basic benefits, as identified by Medicare, no matter where you purchase the policy and no matter which insurance company you purchase the policy from.

Compare plans and rates

What are the Best Medicare Supplement Plans for 2024?

There are a total of 10 standardized Medigap plans.

Benefits vary from plan to plan; however, the following plans have historically been some of the most popular options among Medicare beneficiaries, and are projected to remain popular in 2024:

- Plan F,

- Plan G,

- and Plan N.

Medicare Supplement Plan F

Of all the Medicare Supplement policies, Medicare Plan F is the most comprehensive, meaning that it offers the most coverage for the out-of-pocket expenses that Part A and Part B don’t cover.

The downside of this plan is that only those who became eligible for Medicare before January 1, 2020 can purchase this plan.

If you already had this plan before that date, you can keep it, and if you became eligible for Medicare benefits before the beginning of 2020 but you haven’t yet signed up for benefits and are planning on doing so for 2024, you may be able to purchase Plan F.

What does Medicare Plan F Cover?

Medigap Plan F provides coverage for the following Original Medicare out-of-pocket expenses:

- Part A deductible

- Part B deductible

- Part A coinsurance and hospital expenses

- Part A hospice care coinsurance and copayment

- Part B excess charges (in the event that you see a doctor who doesn’t accept Medicare and they charge more than Medicare has approved for the service you received)

- Coinsurance for skilled nursing facility care

- First three pints of blood for medical procedures

- 80 percent of emergency health care that’s deemed medically necessary while traveling abroad

Medicare Supplement Plan G

Medicare Supplement Plan G is an alternative Medigap option for those who would like as much coverage for out-of-pocket Medicare expenses as possible, but who are not eligible to purchase Plan F.

This plan offers all of the same benefits as Plan F, the only exception being the Part B deductible.

What does Medicare Plan G Cover?

With the exception of the Part B deduction, which you will be responsible for, the following Medicare Part A and Part B out-of-pocket expenses will be paid for by Plan G:

- Part A deductible

- Part A coinsurance and hospital expenses

- Part A Hospice care coinsurance and copayment

- Part B excess charges (in the event that you see a doctor who doesn’t accept Medicare and they charge more than Medicare has approved for the service you received)

- Coinsurance for skilled nursing facility care

- First three pints of blood for medical procedures

- 80 percent of emergency health care that’s deemed medically necessary while traveling abroad

Medicare Supplement Plan N

Medigap Plan N is designed for Medicare beneficiaries who are okay with paying a portion of their copays, as well as a minimum yearly deductible in exchange for lower premiums.

If you don’t foresee needing a lot of healthcare in 2024, yet you want coverage for some of the out-of-pocket expenses that are associated with Part A and Part B, this might be the right Medicare Supplement plan for you in 2024.

What does Medicare Plan N Cover?

If you purchase Medigap Plan N, the following Medicare expenses will be paid for:

- Part A deductible

- Part A coinsurance and hospital expenses

- Part A Hospice care coinsurance and copayment

- Part B coinsurance

- Coinsurance for skilled nursing facility care

- First three pints of blood for medical procedures

- 80 percent of emergency health care that’s deemed medically necessary while traveling abroad

With Plan N, you’ll need to pay copayments of up to $20 for each doctor visit and up to $50 for each emergency room visit (the ER fee is waived if you are admitted to the hospital).

See rates in your area!

How to Choose the Best Medicare Supplement Plan

Nothing is as important as your health, which is why it’s important to carefully consider your options when it comes to choosing a Medicare Supplement plan.

There are several factors that you should take into consideration when weighing your options, such as:

- the current status of your health,

- any pre-existing conditions that you may have,

- your family’s health history,

- and your budget.

After considering these options, compare the different Medigap plans that are available to determine which one will provide the best coverage for your specific needs.

Frequently Asked Questions

What are Medicare Supplement Plans 2024 and how do they differ from other Medicare plans?

Medicare Supplement Plans 2024, or Medigap plans, are private insurance policies that complement Original Medicare. They cover out-of-pocket costs and allow you to see any doctor or hospital that accepts Medicare.

How many Medicare Supplement Plans 2024 options are available?

In 2024, there are 10 standardized Medicare Supplement Plans labeled A, B, C, D, F, G, K, L, M, and N. Each plan offers different coverage levels.

What changes can we expect in Medicare Supplement Plans for 2024?

The coverage remains the same, but premiums may vary. It’s important to compare plans and rates each year.

How do I choose the right Medicare Supplement Plan for 2024?

Consider your healthcare needs, budget, and preferences. Compare coverage and costs of each plan, and review customer reviews of insurance companies.

What are the benefits of Medicare Supplement Plans for 2024?

Benefits include coverage for hospital costs, Part B coinsurance, blood transfusions, hospice care, skilled nursing facility care, and emergency medical care during foreign travel.

Can I change my Medicare Supplement Plan in 2024?

Yes, but there may be restrictions and eligibility requirements. Review your options and consult with a licensed insurance agent.

Are there enrollment periods for Medicare Supplement Plans in 2024?

There are no specific enrollment periods for Medicare Supplement Plans. You can apply at any time, but it’s advisable to enroll during the Medigap Open Enrollment Period.

Do Medicare Supplement Plans for 2024 cover prescription drugs?

No, Medicare Supplement Plans don’t cover prescription drugs. You need a standalone Medicare Part D plan for drug coverage.

How do the costs of Medicare Supplement Plans 2024 compare to other Medicare plans?

Medicare Supplement Plans generally have higher monthly premiums compared to other Medicare plans.

Compare Medicare Supplement Plans 2024 Now!

Before you decide on a Medigap policy, it’s also important to compare quotes from several insurance companies.

To start comparing estimates from the most credible health insurers, submit the form to the right of the screen or call 1-888-891-0229 now!

Updated December 4th, 2022