Mutual of Omaha Medicare Supplement Reviews

Did you recently become eligible for Medicare or will you become eligible soon?

If so and you’re planning on enrolling in Original Medicare – Part A and Part B – you might be thinking about purchasing a Medicare Supplement Insurance plan.

These plans are designed to cover the out-of-pocket expenses that Original Medicare doesn’t cover, such as deductibles, coinsurance, and copays.

Medicare Supplement plans are sold by private insurance companies. Mutual of Omaha, a highly-regarded insurance company, is the second most popular provider of Medicare Supplement Insurance in the United States.

If you’re considering purchasing a Medicare Supplement Insurance plan through Mutual of Omaha, before committing, it’s important to do your due diligence by researching the company so you can make an informed decision.

To help you make the right decision and ensure you’re medical expenses are as manageable as possible, below, we provide a review of Mutual of Omaha and the Medicare Supplement plans the company provides.

What are Medicare Insurance Supplement Insurance Plans?

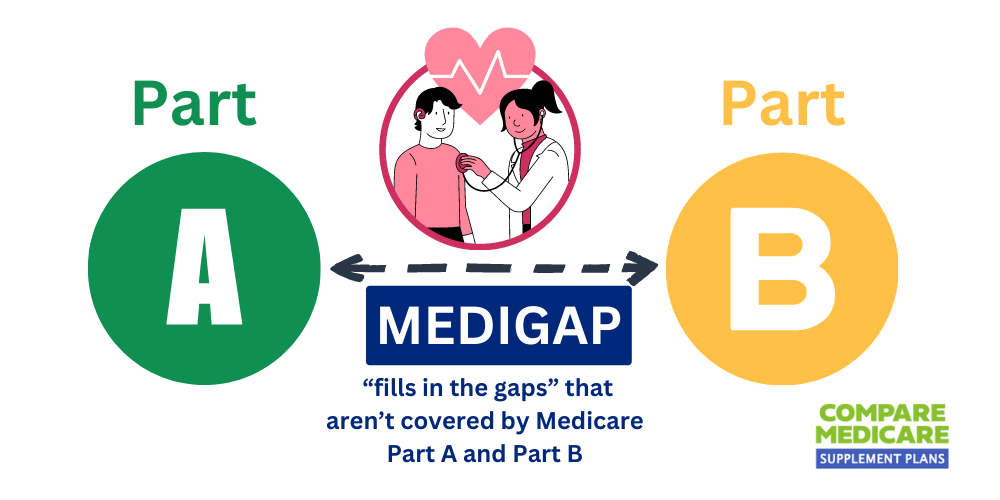

Medicare Supplement Insurance plans, or Medigap, are additional insurance plans that work alongside Medicare Part A and Part B (Original Medicare).

They help to fill in the gaps in Original Medicare by covering the out-of-pocket expenses the government-funded health insurance program doesn’t cover; copays, coinsurance, and deductibles, for example.

There are 10 different Medicare Supplement plans, which are denoted by different letters.

The coverage that each lettered plan offers varies; however, all plans that are the same letter must provide the same standard coverage, as required by the federal government.

It should be noted that you will need to pay an additional premium for Medigap insurance, in addition to the premium for Original Medicare.

Premiums vary and are charged on a monthly basis. That said, Medicare Supplement Insurance can help you save a substantial amount of money on your health insurance costs.

Compare Plans & Rates

Enter Zip Code

About Mutual of Omaha

An insurance and financial services company, Mutual of Omaha was founded more than 100 years ago.

Today, the company is one of the largest providers of Medicare Supplement Insurance in the United States.

The company offers coverage in 49 states and Washington, DC; the company does not offer insurance in Massachusetts.

Mutual of Omaha does not provide any other type of health insurance plan, including Medicare Advantage; rather, it specializes in policies that are specifically designed to work alongside your Original Medicare insurance coverage.

The company services millions of Medicare beneficiaries throughout the United States and has a solid reputation for offering quality products, reliable service, and affordable rates.

Benefits and Disadvantages

There are both upsides and downsides to purchasing Medicare Supplement Insurance through Mutual of Omaha.

Benefits

- Mutual of Omaha Medigap policies can be purchased in all states, as well as the District of Columbia, with Massachusetts being the only exception.

- The company has a history of high customer satisfaction; in fact, complaints are among the lowest in the insurance market industry.

- The company offers all 10 Medicare Supplement Insurance plans

- There are large discounted rates available to those who live in the same household as others who also have Medigap insurance through Mutual of Omaha; up to 12 percent, which is one of the largest discounts available.

- In addition to the standard benefits, Mutual of Omaha offers Medigap policyholders extra perks, such as coverage for hearing aids and vision care, as well as wellness discounts.

Disadvantages

- While Mutual of Omaha does offer all 10 standard Medicare Supplement Insurance plans, many are limited in terms of availability and eligibility; Plans A, G, and N are the options that are available to all Medicare beneficiaries in most locations.

- As mentioned above, Mutual of Omaha does not offer Medigap insurance in Massachusetts, so if you reside in this state and you would like to purchase supplemental coverage, you will need to do so through another company.

What Medicare Supplement Plans Does Mutual of Omaha Offer?

As stated above, Mutual of Omaha offers all 10 standardized Medicare Supplement Insurance policies; however, eligibility and availability vary.

The state in which you reside, as well as the date that you became eligible for Medicare benefits, may impact your ability to purchase certain policies.

Of the 10 Medigap Plans Mutual of Omaha offers, Plan A, Plan N, and Plan G are the three options that are available in any state and to any Medicare beneficiary.

- Plan A. Plan A is the most basic Medigap policy, as it only provides the benefits that are required by the federal government; nothing more.

- Plan G. This plan offers the most coverage for out-of-pocket expenses.

- Plan N. Plan N is designed to keep monthly premiums low; however, the copays are higher.

In addition to these Medicare Supplement Insurance plans, Mutual of Omaha also provides Plan F, which offers the most comprehensive coverage of all Medigap plans; however, it is only available to beneficiaries who become eligible to enroll in Medicare before January 1, 2020.

For new enrollees, Plan G serves as an alternative, as it offers all the same benefits, except coverage for the Part B deductible.

Mutual of Omaha also offers Medigap Plan B, C, D, K, L, and M; however, these plans are only available to certain beneficiaries and/or in certain locations.

Mutual of Omaha Member Reviews

Mutual of Omaha has a track record of providing quality customer service and meeting the needs of its insurance policyholders.

In fact, compared to other insurance companies, according to recent data, the complaint rate for Mutual of Omaha was 59.4 percent lower than the average when compared to all companies that sell Medicare Supplement Insurance.

This is a clear indicator that the company takes pride in meeting the needs of the customers they serve.

Frequently Asked Questions

What are the key features of Mutual of Omaha Medicare Supplement plans?

Mutual of Omaha Medicare Supplement plans offer coverage for deductibles, copayments, and coinsurance not covered by Original Medicare. They also provide flexibility to choose your own doctors and hospitals.

How do Mutual of Omaha Medicare Supplement plans compare to other providers?

Mutual of Omaha is a well-established insurance company with a strong reputation for customer service. Their Medicare Supplement plans are known for competitive rates and reliable coverage.

Are Mutual of Omaha Medicare Supplement plans available nationwide?

Yes, Mutual of Omaha offers Medicare Supplement plans across the United States. Their plans are available in most states and can provide coverage wherever Original Medicare is accepted.

How do customers rate Mutual of Omaha Medicare Supplement plans?

Mutual of Omaha generally receives positive reviews for their Medicare Supplement plans. Customers appreciate their competitive rates, comprehensive coverage, and responsive customer service.

What are the different types of Mutual of Omaha Medicare Supplement plans?

Mutual of Omaha offers several standardized Medicare Supplement plans, including Plan A, Plan C, Plan F, Plan G, and Plan N. Each plan provides different levels of coverage to meet varying needs.

Can I keep my doctor if I choose a Mutual of Omaha Medicare Supplement plan?

Yes, with Mutual of Omaha Medicare Supplement plans, you have the freedom to choose any doctor or hospital that accepts Medicare patients. There are no network restrictions.

How can I enroll in a Mutual of Omaha Medicare Supplement plan?

To enroll in a Mutual of Omaha Medicare Supplement plan, you can contact Mutual of Omaha directly or work with a licensed insurance agent who specializes in Medicare plans. They will guide you through the enrollment process.

Are there any waiting periods for coverage with Mutual of Omaha Medicare Supplement plans?

If you enroll in a Mutual of Omaha Medicare Supplement plan during your initial enrollment period or guaranteed issue rights, there are no waiting periods for coverage. However, if you apply outside these periods, there may be a waiting period for pre-existing conditions.

Can I switch from my current Medicare Supplement plan to Mutual of Omaha?

Yes, you can switch from your current Medicare Supplement plan to a Mutual of Omaha plan. However, it’s important to consider any waiting periods and compare coverage and costs before making a decision.

Does Mutual of Omaha offer additional benefits with their Medicare Supplement plans?

Mutual of Omaha offers some additional benefits with their Medicare Supplement plans, such as coverage for foreign travel emergencies and access to their SilverSneakers fitness program. These benefits can vary depending on the specific plan.

Should You Purchase Mutual of Omaha Medicare Supplement Insurance?

Given the low complaint rate and high level of customer satisfaction, combined with the variety of Medigap plans the company offers, the additional perks and the quality of customer service provided, Mutual of Omaha has a track record of success and a solid reputation as a Medicare Supplement Insurance provider.

To compare Medigap quotes from Mutual of Omaha and other reputable insurance companies, fill out the form to the right or dial 1-888-891-0229 and our agents will assist you right away!

Updated December 4th, 2022